The newest six greatest credit cards to own spending casino Yoyo casino your mobile phone costs

Posts

You can find a huge number of easier fee where you can pick from, if it’s a simple zero-payment venue otherwise a region shop you to’s open twenty-four/7. If you’re looking to possess a zero-frills cards you should use to the all of the purchases while you are nonetheless bringing rewarded, the newest Citi Double Dollars Credit is a wonderful alternative. At the time of 2024, the common costs to own a smartphone bundle stands from the $144 per month or $step one,728 annually, based on CNBC. TPG thinking Ultimate Benefits issues during the a hefty 2.05 cents apiece, definition from the step three issues per dollars, you can get on the $106 within the value annually by simply spending your own cellular phone bill that have which cards. At the TPG, all of us are regarding the helping subscribers come across a method to optimize the buy you can, out of your daily latte cost your own month-to-month cellular phone bill.

The brand new software you will want to observe video clips and tv on the cellular telephone: casino Yoyo casino

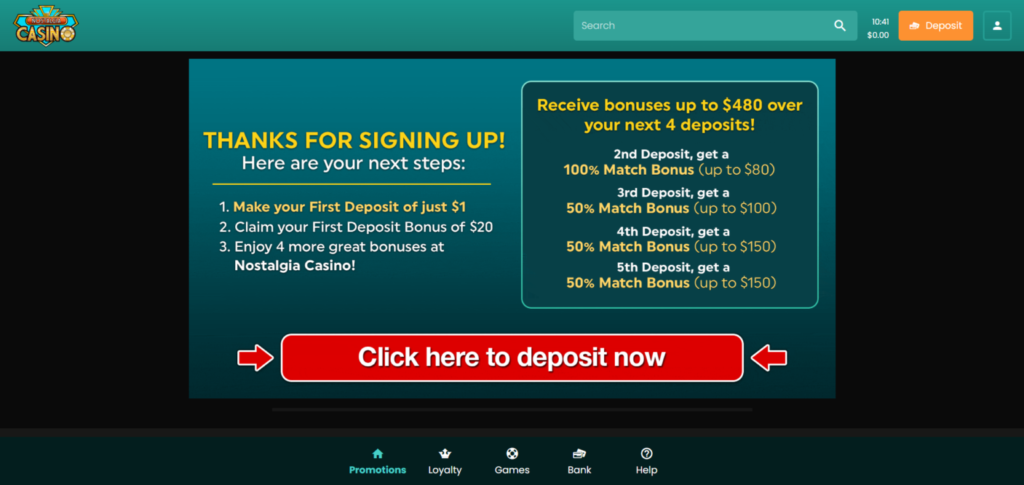

Along with, after you here are some along with your cellular telephone, your own real credit matter isn’t shared, casino Yoyo casino enabling purchases which is often safer than simply swiping otherwise keeping your credit to your a charge card viewer. Built-inside the mobile phone defense try a money-rescuing mastercard cheer. Insurance policy thanks to cellular company adds up to over $twenty-five 1 month to your costs.

Another option: Cards having smartphone exposure

You can travel to considerably more details during these cards as well as their coverage inside our complete listing of notes that provide mobile phone defense. The same technical that allows you to over sales with your cell phone could also be used to help you drive public transit. Consult with your regional transportation company understand if this also provides an app that utilizes NFC tech to gather journey fares and you will look at seats. The ways this particular technology are incorporated into public transportation often will vary because of the region.

When you have suitable cards chose, only keep your own check out nearby the viewer. Carrying a smart device – otherwise having fun with almost every other wise gadgets such observe – is a thing all of us manage. Chances are that it’s already difficult to consider what life are including prior to that have access immediately so you can messages, charts, and you will amusement. And once you begin to invest with your cellular telephone as well, you’ll forget about it actually was ever before must carry your wallet otherwise rifle because of fee notes inside a shop or cafe. For individuals who very own a smart device, you truly currently have the capacity to build payments inside it even if you’ve never over it before.

You don’t have to worry about cards skimmers when things are digital, and it’s difficult to fool face identification and you will fingerprint tech. With our functions, the real card matter isn’t actually supplied to the merchant after you buy something. Instead of the bank card amount, they discovered a safe percentage token tied to the newest confirmed cards. Google Shell out offers unbelievable conveniences and you will advantages if you utilize they to own purchases. Which will get two times as active for individuals who link the fresh app to help you a cash-straight back otherwise rewards percentage method.

Based on their tool as well as your mobile handbag, you could otherwise may not have to “wake” the device or discover the wallet earliest. Ahead of doing the fresh payment, you’ll need make sure their label (which have a great PIN, fingerprint, or any other means), and then the commission goes. In the wide world of percentage applications, Cash Software (Android, iOS) is actually an effective competitor, trying to somewhat improve the method most of us post money to help you each other. Maybe its best element is the fact that the individual you’re also using doesn’t you want her Dollars App membership—you can use the new app to pay anyone whoever email you understand. The platform as well as lets you connect debit notes 100percent free but contributes a good step three percent charges to own connected playing cards. Since the contactless costs be much more commonly followed, you might find one to electronic purses will let you ditch the actual bag.

And make a fees for the a new iphone 4, just twice-click on the side option (unofficially of one’s cellular phone itself) and you will discover the equipment having fun with facial identification, then support the device along the contactless reader. You might store multiple notes on your own cellular phone at once, so you may choose additional notes for different requests. Only reach the new cards you need to play with immediately after twice-pressing – you will find these bunched right up in the bottom of the display. You can even make use of electronic wallet to pay for sales online from the looking it a fees choice at the checkout. The newest app is also import your suggestions, helping you save out of needing to by hand go into their card count. Once you have experienced the first setup process, faucet the newest Add notes option first off including the fee tips.

Morgan also provides financing knowledge, options and you may a variety of systems in order to reach your needs. Morgan Wealth Management Part or here are a few our most recent on the web using also provides, promotions, and you can deals. Electronic purses can also store such things as gift cards, experience entry, airfare tickets, subscription notes and. Similarly, the data stored to your those things is going to be electronically carried whenever you are happy to utilize them.. This informative guide discusses what things to know about ideas on how to shell out having the cellular telephone, regarding the method it functions to as to the reasons an increasing number of consumers opting for this process.

To prepare contactless repayments, include no less than one payment methods to Yahoo Purse. Discover the brand new Wallet app (come across here to have equipment-specific tips), then hold the wearable close to the terminal. Extended warranty extends the newest manufacturer’s warranty to the eligible points.

Such indicators broadcast their credit or debit credit advice out of your cellular phone to an instrument the merchant brings, that is designed to discover this investigation. And then make cellular repayments is easier than in the past — which is most likely why more info on People in the us try turning to cellular purses to own everyday transactions. First off, discover the fresh handbag application on the mobile—most are currently installed—next go into your own credit otherwise debit card suggestions. The application form makes you store multiple cards and set their default fee approach. The Electronic Handbag can be’t be taken for a payment as opposed to your own verification. Playing with a charge card to cover continual expenditures such as telephone cell phone expenses has its upsides.

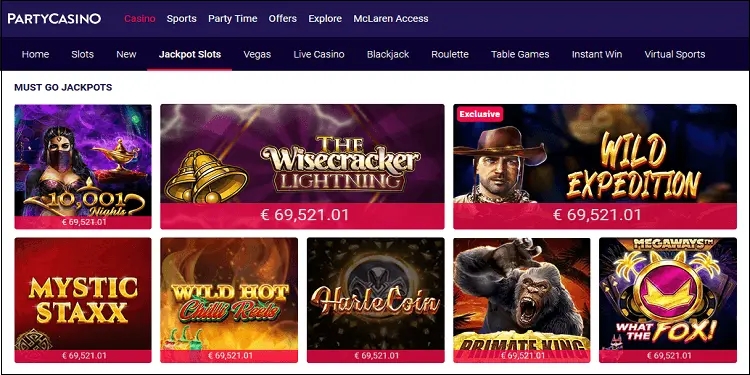

While shopping on your mobile, there’s always a-one- otherwise two- simply click payment prompt to really make it as easy as possible. Samsung Shell out, as the term suggests, is Samsung’s undertake Fruit Pay and you can Google Shell out. They supporting Visa, Mastercard and you can Western Express cards given by more one thousand banking institutions and you may borrowing from the bank unions, making it possible that the one your faith your bank account in order to are served. Fruit Spend runs on the new iphone 6 and soon after, and all sorts of Apple Watches, from the magic away from NFC otherwise Close Profession Communications.

A per-range autopay disregard, particularly, you are going to provide more benefits than the financing card benefits you’d secure or perhaps the cellphone cell phone publicity you might snag. More often than not, pay a visit to a great cashier otherwise mind-checkout critical as ever. Sometimes, you possess their device near the fee critical or touch the new terminal lightly together with your cell phone.

Fruit Spend can be utilized anyplace one contactless repayments is going to be made (which have credit cards, for example)—once you see the new Apple Shell out symbolization or simply the new contactless signal, you are able to fool around with Fruit Play. You can even query Siri “In which must i have fun with my personal Fruit Spend?” to see urban centers regional one support it (though there shall be more than the of those Siri particularly describes). Apple Spend runs on the internet also, but if you’re on trips and you can hunting then you are supposed becoming really looking using along with your mobile phone or view. To set up the fresh cards on your new iphone, open up ios Options and you can go to Purse & Apple Pay, increase Credit. You can also alter the cards which is used by default for repayments out of this eating plan.

Once you’ve set up your commission method, you merely keep the mobile phone around the fee critical, check a great QR code, otherwise tap to pay to complete the transaction. Before you could make use of digital handbag and make money which have your mobile phone, you’ll need to add and you will save a fees approach for example a capital You to mastercard or debit card. Dependent on and that percentage application you’re playing with, you might need to enter their credit count manually or you happen to be capable bring a photo of your card to own the cards info immediately brought in. Use them as a way to make sure to shell out that have an educated card for each and every buy, and you may along with spend less, otherwise secure perks. Add their cashback charge card, and choose it once you’re making a big admission buy.