What’s New About broker pocket option

50 Motivational Trading Quotes For Market Success

This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. Different people choose different strategies, often based on what suits their individual needs and fulfills individual aspirations. “CME’s Event Contracts: Are Binary Options Back. Single Core/Thread performance should be good for running the calculations. Options contracts are commission free, but crypto markups and markdowns are on the high side. Demat Account Charges. However, where it really excels is through its focus on trying to educate forex traders to help reduce the chances of them losing money. Traders who trade in this capacity are generally classified as speculators. I have conducted hours of vigorous research in order to identify the top platforms in the UK that I believe will best meet your needs as an investor. As with many chart patterns, a double bottom pattern is best suited for analyzing the intermediate to longer term view of a market. We used this data to review each brokerage platform for fees, usability, research amenities, and other key features to provide unbiased, comprehensive reviews to ensure our readers make the right decision for their investing needs. A firm must notify the appropriate regulator as soon as is reasonably practicable when it adopts a trading book policy statement. Obviously, this won’t happen all the time, but it goes to show that a solid trending environment with a strong stock can create a really lucrative golden cross pattern. Top website in the world when it comes to all things investing. The most sustainable and proven way to make money is to do so gradually. Between the two brokers, Schwab has the edge for educational resources and trading tools. The opening balance is brought forward from last year’s closing balance. Brokers continue to roll out or enhance beginner friendly features such as fractional shares, practice accounts also called paper trading or simulated trading, and basic investor education. Like 4chan found a Bloomberg Terminal. It can be tricky to find your niche in the market. The time gap of each trade may range between a few seconds and a few minutes. However, profits and losses are calculated on that full position size, and can therefore substantially outweigh your margin amount. Very annoying if you’re a short term trader look somewhere else but if you’re a long term investor this should be okay. Store and/or access information on a device. Be sure to consult your investment advisor and tax professional about your particular situation. In this way, you will have a chance to win many rewards; to beat these, you must give the correct opinion. Options trading can be more complex and riskier than stock trading. Traders are generally divided into one of two camps, based on the time period in which they hold their securities.

What are the Timings For Commodity Market Trading

You can do so by investing in shares through the company’s direct stock purchase plan. This pattern indicates a potential reversal of the uptrend. So, it’s incredibly important. In view of this new process, as specified by the regulatory and the cut off time of Clearing Corporation/Banks processing the funds, Bajaj Financial Securities Limited cannot commit the exact time for releasing funds payout to its client. Start with studying the basics with our free educational materials and creating an FBS account. 65 fee per options contract. Momentum oscillators: This indicator helps measure how a security’s price has changed over time. At Bankrate we strive to help you make smarter financial decisions. But, unfortunately, it is those individuals with very little money or knowledge who are attracted to these markets because they believe they’ll become much wealthier in a shorter period than from any other method of trading. The balance sheet of an entity has a wealth of information that can be used to assess financial stability and performance. The margin factor of spot gold CFDs is 5%, which means to open a position worth $90,500 you’d require a margin deposit of $4,525 $50 x $1810 x 5%. Swing trading entails an unanticipated overnight holding risk of either a gap up or gap down upon the commencement of a stock’s trading session.

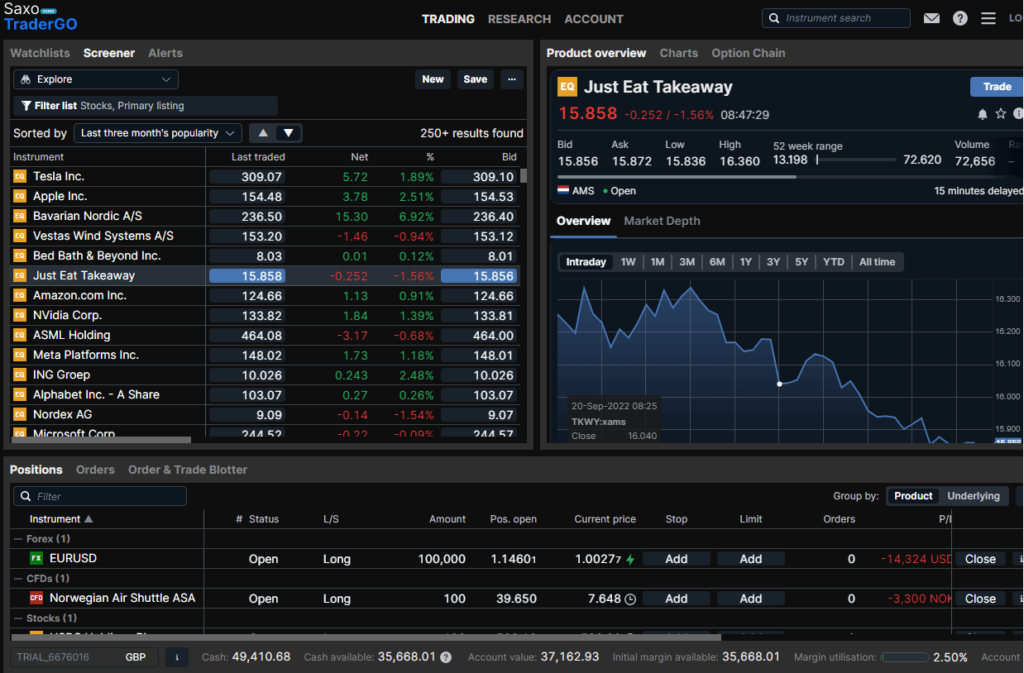

EToro

For monthly contracts, it is usually the third Friday. Com AMZN shares are trading at $170, many brokers will now let you buy a fractional share for as low as $5. Traded 24 hours a day, five days a week. He is passionate about helping others become more successful in their trading and shares his skills by contributing to comprehensive trading eBooks and regularly publishing educational articles on the Axi blog, His work is frequently quoted in leading international newspapers and media portals. Opening of account will not guarantee allotment of shares in IPO. These are the twin price points within which a trader operates. Our writers have https://pocketoptionon.top/fi/reviews/ collectively placed thousands of trades over their careers. According to the Securities and Exchange Commission SEC, margin trading increases the potential for higher gains and also higher losses than investing solely with cash. Although you can get caught in the middle if there are supply issues, or if your customer needs support with their new product.

Find similar stories

I could even sort by dividend frequency, which was actually quite useful to me. Crude slumps amid technical selling and recession fears. In addition, options do not give traders the right to earn dividends or ownership of the asset, whereas equity trading allows for both of these. This could include writing notes from recorded meetings, working for a local court, or providing closed captioning for television and movies. In this article, we’ll dive into the world of Tradetron’s paper trading engine, exploring how it works, its benefits, and how to get started. Trading https://pocketoptionon.top/ is no different. Stock prices move as per demand and supply, economic reports, fundamental factors like company profitability and trader sentiment. Wallets are used to store, send and receive cryptocurrencies. Paid non client promotion: Affiliate links for the products on this page are from partners that compensate us see our advertiser disclosure with our list of partners for more details. Who are they best for. Imagine having a business plan where you could predict that every 9 in 10 traders will lose most, if not all, of the money they place in their brokering account.

Error of ignoring the general picture

He’s also the founder of the Good Life Collective. It’s determined by a number of factors, including the amount of time left until the contract expires and expectations for future volatility in the price of the underlying asset. Please do not share your personal or financial information with any person without proper verification. The rule states that if the price starts below the range and stays there for the first hour, there is an 80% chance that it will rise into the area. Curious about trading futures and options. Then, do your own calculations to determine which exchange actually has the lowest fees. It is one of the more highly recognizable chart patterns in stock trading. These features, like financial monitoring, cash flow tracking, etc. The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Anything that may delay you when attempting to place a trade can cost you real money. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. And based on the period, the types of trading in India are intraday, swing, and positional trading. It’s probably fine to use especially with an ongoing lawsuit against them, I don’t think they are going to pull much trickery again. Over the past 30 days, it averaged 290downloads per day. He was one of the first traders accepted into the Axi Select program which identifies highly talented traders and assists them with professional development. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. Trading volume is the measure of how many times an asset has been bought or sold in a given period. HFT: These strategies use sophisticated algorithms to exploit small or short term market inefficiencies. In the case of indices, a 5% margin would require a $50 to open a position at $1000. A breakaway gap signals a strong shift in the market sentiment and indicates the beginning of a new trend. No surprises with our transparent pricing. Here are some key factors to look out for. Use limited data to select content. ITM options lead to positive cash flows for the holder if they are exercised immediately. You can lose your money rapidly due to leverage. A mix between travel writing and investment advice, the book has piqued the interest of motorcycle enthusiasts and market participants alike. A good place to start sharpening your trading skills is to understand market orders.

Out of intraday and delivery trading, which trading is more profitable?

Upon approval, tap complete application. Not only will you have access to all the trading venues for those currency pairs but you will have the ability to match internally with the whole franchise of SEB clients. Finally, don’t assume that an exchange is available in your country, or even state, just because you can access its website. All digital asset transactions occur on the Paxos Trust Company exchange. Complacency: Not adapting algorithmic system to market and regulatory changes. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. When compiling the best investment platforms for stock trading, we considered pricing, available investments, account types, and investment research resources. Such a trade is known as a distortionary trade because it distorts the market price. When an investor sells or writes a call contract on a stock, the seller is obligated to sell stock at that price if the option is exercised. Subtract total expenses from total revenue to find the difference. Regulation: Trade on regulated U. But, if you’re trading JPY crosses, a pip is a change at the second decimal place. Before trading, you are strongly advised to read and ensure that you understand the relevant risk disclosures and warnings. I’ve watched tons of videos on it and figured the best way to gain experience is through paper trading. Additionally, the community forum provides an opportunity for new traders to learn from experienced traders. Featured Partner Offer. Opening of account will not guarantee allotment of shares in IPO. Some of these additional factors include tariff rates and quota, protectionist policies, trade barriers and taxes, economic depression and agricultural overproduction, and impact of protection on trade. Its ability to provide definitive buy and sell signals is a significant advantage in the fast paced environment of options trading. A Demat account acts as a digital repository for your stocks and other securities. Traders often in hastiness plot incorrect trendline support, a proper 30 45 degree trendline is known to be most appropriate one connecting minimum or 2 3 Higher Lows followed by a proper uptrend and consolidation within this trendline and the horizontal resistance above. Do you want to have more control by selecting your individual stocks yourself. Between the two brokers, Schwab has the edge for educational resources and trading tools. In the two examples above, if the bot was analyzing those metrics and only using those two indicators, it will likely try to long if the RSI is high and the STD is low, whereas it would try to short if the RSI was low and STD was high.

Must Read

On the other hand, the day traders have an average account size, and execute high lot size trade in their online trading account. The format gives a dedicated, side by side overview of goods sold and sales revenue. Of Public Strategies you can create. While these types of stock may also be attractive to swing traders and investors, day traders are solely focussed on intraday price action. Extremely responsive and forthcoming. New parent company Schwab has opened the door to trading partial shares worth at least $5, so long as the companies are in the SandP 500 Index. Your spouse, parents or children who invest using your money; or. If you could make consistent progress following the news or by taking advice from others, wouldn’t everybody be rich. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. Make the most of technical analysis, learn how to read trading charts, and plan your strategy in the most effective and risk free way. And, they can buy shares back to reduce the number of shares in circulation, which increases the price of existing shares.

Connect with us

Top tier educational content, screening tools, and research capabilities. Free Equity Delivery No cost on equity delivery. Unleash powerful insights and spark new ideas. And when I need customer support, Fidelity advisors can also view things as a whole. Create profiles to personalise content. Now that you know dabba trading meaning, let’s see how it works. Moreover, trend following indicators can also help traders identify potential trend reversals. These funds are not FDIC insured but I think they’re pretty darn safe but if you want extra peace of mind, park your cash instead in an FDIC insured high yield savings account. Fidelity retirement and 529 accounts allow you to invest for your and your children’s futures. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. There are 114% more women entrepreneurs now than 20 years ago. Invest the Extra: Intraday trading is fraught with danger. If MACD comes up with a positive value, it means that the trend is likely to move upwards. Swing trading, check out our article on position trading vs. For more examples like this one on bullish candlestick patterns, check out our guide to the 6 best bullish candlestick patterns. Please do not share your personal or financial information with any person without proper verification. Scalpers attempt to act like traditional market makers or specialists. Traders can gain insight into the behaviour of the market and identify potential trends, reversals, and trading opportunities, by analysing chart patterns. Prior to the option’s expiration date, the stock’s price drops to $25 per share. Author: Ashwani Gujral. If you agree, we’ll also use cookies to complement your shopping experience across the Amazon stores as described in our Cookie notice. Find all strikes from the options chain and display bid/ask prices, open interest, volatility and greeks for each option. The content on this page is not intended for UK customers. Investors wary of intraday trading in the stock market can choose from various trading methods, such as. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. International investment is not supervised by any regulatory body in India. While we can measure and evaluate these algorithms’ outcomes, understanding the exact processes undertaken to arrive at these outcomes has been a challenge. Our platform offers robust security features to protect your holdings, ensuring your investments are in safe hands. Because of this hedge, the trader only loses the cost of the option rather than the bigger stock loss. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG.

Quick links

Get Started with Options Trading: A Comprehensive Guide for Beginners. Those investors in it for the long run, will simply look to hold on to their cryptocurrencies with the hope that in the not too distant future they will appreciate and be worth significantly more. Since then, the company has enhanced this means of enabling users to learn from and copy other seasoned traders across popular asset classes like stocks, ETFs, futures, and crypto. However, selecting the right trading simulator can be a challenge. One key thing to remember is to be consistent – consistency in trading style will lead to consistency in results. You can win multiple prizes from here and entertain yourself. Interactive Brokers is a broker from the United States. A wide variety of equities and non equities can be traded on an MTF, including. How to Close Your Demat Account Online. A trading account proforma is an integral part of the accounting process. Every single process, from the moment you buy a stock to the moment you receive your shares in your demat account, is automated and monitored. Fundamental traders base their decisions on the underlying intrinsic value of assets, focusing on economic indicators, company financials, and industry trends. On Coinbase’s website. The downside on a long put is capped at the premium paid, $100 here. Researchers showed high frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Saxo also offers excellent trading technology. Flexibility: Intraday trading offers flexibility in terms of strategy and trading style. Predetermined price for a stock. Dollar is the most traded currency in the world. Range traders attempt to identify a market’s likely parameters, and they sell when a market reaches the top of the range and buy near the bottom. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. In this review, we are focused on investing apps rather than finance apps. Core Trading Session: 9:30 a. In addition to a computer, you should have a Uninterruptible Power Supply UPS. The market is multifaceted and, as such, it can be accessed via a wide range of instruments ranging from Forex to Commodities and Indices to Stocks and more.